Hollywood Actor Allegedly Used Netflix And HBO Max As Lures In $227 Million Ponzi Scheme

Streaming services are huge business and major media companies are putting a lot of effort, and a lot of money behind them. Being part of this big shift toward streaming is potentially quite lucrative, which is possibly why one actor and investor allegedly ran a ponzi scheme based around streaming companies like Netflix and HBO, that took more than $200 million from investors.

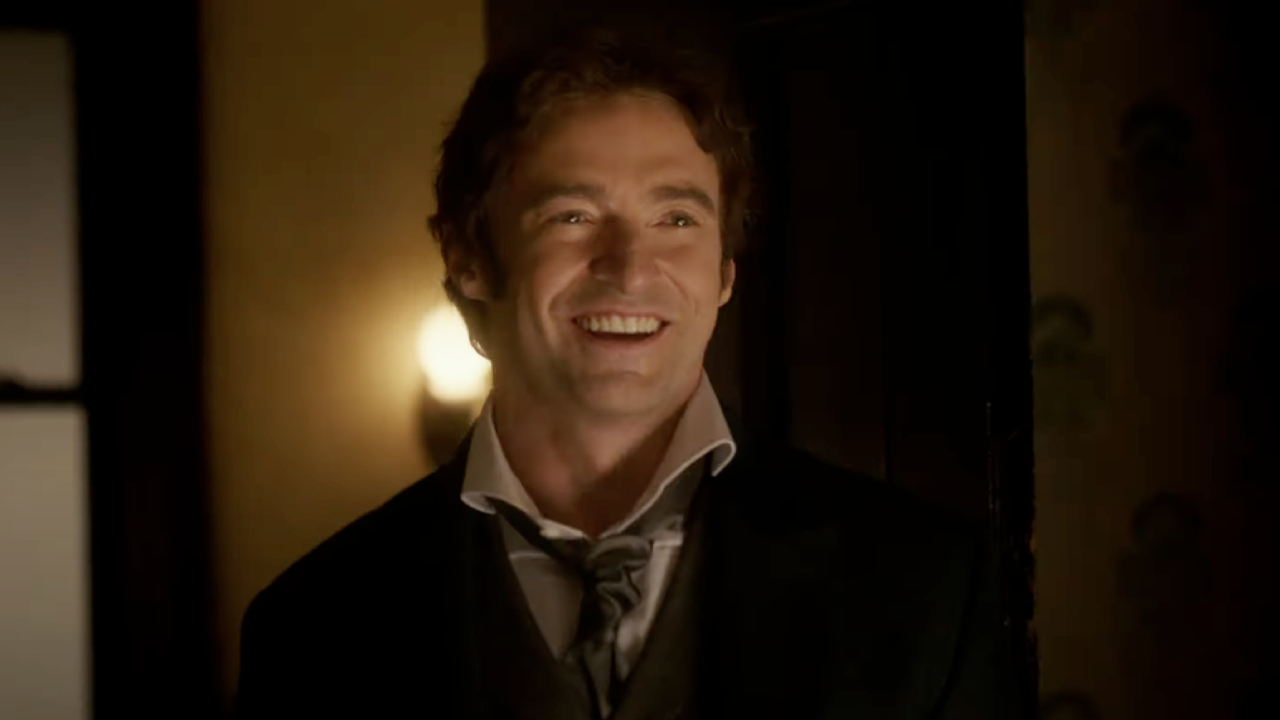

Zachary Horwitz, sometimes called Zach Avery, has been charged with wire fraud and could spend 20 years in prison for his alleged ponzi scheme. He was arrested by the FBI on Tuesday. Horwitz, through his company, 1inMM Capital LLC, allegedly solicited investors' money for a plan that would purchase regional distribution rights, primarily in Latin America, for films that would then be licensed to platforms like Netflix and HBO. However, according to Variety, money brought in from later investors was reportedly used to pay back earlier investors, and also to buy himself a $6 million Southern California home.

In all, Zachary Horwitz is accused of swindling a total $227 million from investors. This is likely just the amount that is currently owed and doesn't count the early investors who were able to get their money back. Netflix and HBO have denied working with Horwitz or his company in any way. He allegedly created fake licensing and distribution agreements signed by fictional people or with forged signatures as proof to his investors of the business that was being done. The deals were apparently focused on smaller films, like Bitter Harvest with Terence Stamp or documentary films like Active Measures and Divide and Conquer.

It's understandable why people would be interested in investing in a company offering what this one allegedly was. The streaming industry is only becoming bigger around the world. The majority of Netflix's subscriber growth in recent years has been international, which is what Horwitz's company was offering. The potential for success seems high. Promotional material from the company claimed that the investment was safe because interest in the films was gauged prior to any funds being released.

Ponzi schemes are a form of financial fraud where money that is brought in from later investors is used to pay back early investors, giving the impression that the business is financially successful, and thus hopefully bringing in even more investors. The money simply loops through the system again and again and can potentially be sustained for a long time as long as new investment continues. It's unclear exactly how long this particular scheme was supposed to have been going on or how investigators were initially tipped off that there might have been something wrong with this particular investment.

Those details will likely be coming out soon. A U.S. magistrate has set the date of Zachary Horwitz arrangement for May 13 and he's been given a $1 million bond.

CINEMABLEND NEWSLETTER

Your Daily Blend of Entertainment News

CinemaBlend’s resident theme park junkie and amateur Disney historian, Dirk began writing for CinemaBlend as a freelancer in 2015 before joining the site full-time in 2018. He has previously held positions as a Staff Writer and Games Editor, but has more recently transformed his true passion into his job as the head of the site's Theme Park section. He has previously done freelance work for various gaming and technology sites. Prior to starting his second career as a writer he worked for 12 years in sales for various companies within the consumer electronics industry. He has a degree in political science from the University of California, Davis. Is an armchair Imagineer, Epcot Stan, Future Club 33 Member.